Trading Walls: Canadian Tariffs and the Future of Modular Construction

As modular construction continues to gain momentum in Canada’s housing and infrastructure conversations, much of the public discourse focuses on speed, labour shortages, and delivery timelines. Yet one of the most consequential, and least understood, factors shaping the feasibility of modular and prefabricated construction is Canada’s trade and tariff framework.

For an industry rooted in industrialized manufacturing, global supply chains, and repeatable building systems, tariffs are not a secondary consideration. They influence cost structures, procurement strategies, financing risk, and ultimately whether prefabrication can scale in a meaningful way.

This becomes especially relevant not only for volumetric modular buildings, but also for unitized wall panels, panelized systems, and other prefabricated building components increasingly used across mid-rise and high-rise construction in Canada.

How Canada Classifies Modular Buildings for Customs

Under Canada’s Harmonized System (HS) for customs duties, modular building units are classified under the tariff category HS 9406, “prefabricated buildings.” More specifically, as an example, steel volumetric modules typically fall under the subheading 9406.20.00.00. This category includes modular units that are fully constructed in a factory and shipped for installation, rather than traditional on-site construction with sticks and bricks.

Because modular homes and buildings are treated as manufactured goods rather than construction services, they are subject to import duties based on the country of origin and Canada’s trade agreements. However, not all prefabricated building systems are captured under a single tariff heading.

Where Unitized Wall Panels and Building Components Fit

Unlike fully volumetric modular units, unitized curtain wall systems, prefabricated façade panels, floor cassettes, and panelized structural assemblies are often classified under different HS chapters, depending on their material and level of completion.

Common classifications include:

HS Chapter 73 for fabricated structural steel components

HS Chapter 76 for aluminum curtain wall systems and façade panels

HS Chapter 44 for wood-based prefabricated wall panels and CLT assemblies

HS Chapter 70 for glass units integrated into façade systems

This means that unitized wall modules, even when designed as part of a modular or off-site construction strategy, may be subject to entirely different tariff treatments than volumetric modules. In practice, this creates a fragmented tariff landscape where one project may involve multiple HS codes, each with different duty rates and trade risks.

This complexity is particularly relevant for high-rise residential and institutional projects that rely on unitized façades manufactured overseas, a common practice in global construction markets.

Free Trade Agreements vs. Non-FTA Imports

Canada participates in several major free trade agreements that influence tariff treatment:

Under CUSMA (Canada-U.S.-Mexico Agreement), goods produced in the United States or Mexico can enter Canada duty-free if they meet the agreement’s rules of origin.

Similar preferential treatment exists for CETA (Comprehensive Economic and Trade Agreement with the European Union) and CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership), provided the goods originate in partner countries and comply with origin requirements.

This means that modular units or components manufactured in FTA partner countries often incur 0% duty, significantly reducing barriers to factories operating in those markets.

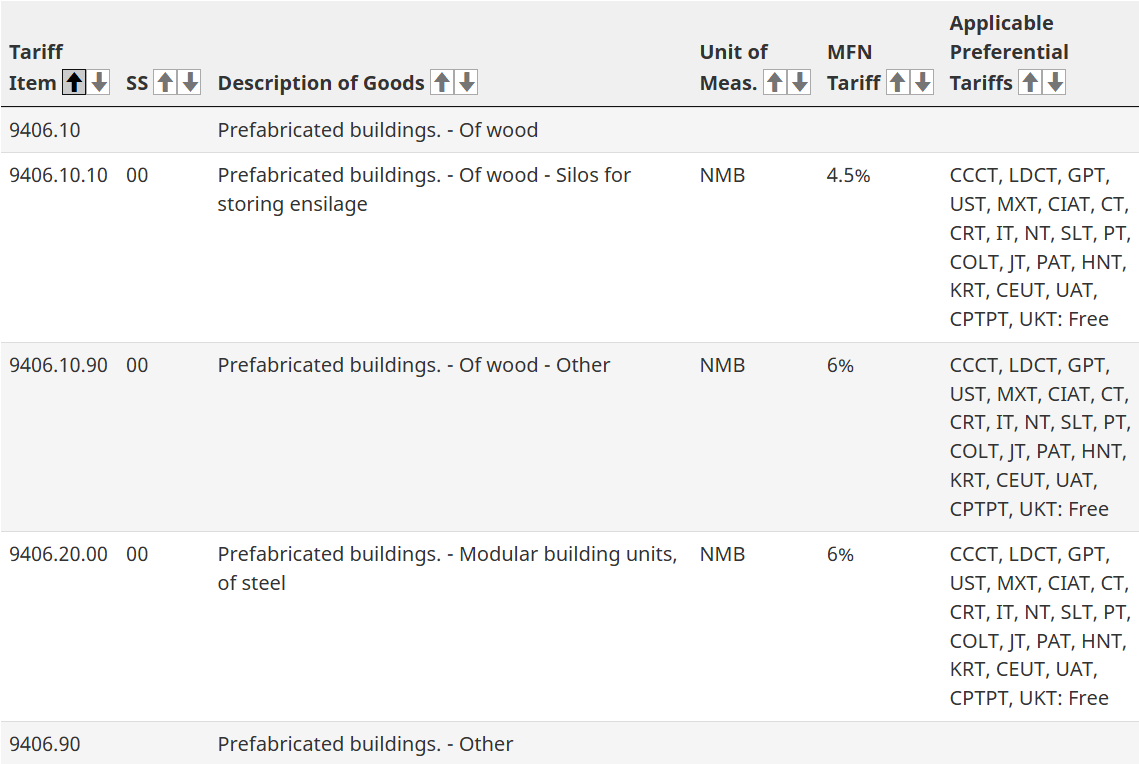

Customs Tariff Chart from CBSA website

Imports From Countries Without FTAs: The China Case

Canada does not have a free trade agreement with China. As a result, modular building units imported from China are subject to Canada’s Most-Favoured-Nation (MFN) tariff rates under HS 9406. An analysis of Canada’s tariff data suggests MFN duties on prefabricated buildings can range roughly between 4.5 % and 15.5 % depending on the precise sub-category and materials, though steel modulars typically fall in the 4.5–6 % range under traditional MFN duty tables.

A tariff of this magnitude, while not prohibitive on its own, becomes a real consideration in modular construction because the industry often operates with thin margins and high upfront capital costs. Every percentage point in duty adds to the landed cost of a factory-finished unit, affecting project viability, financing, and pricing.

Beyond Standard Tariffs: Anti-Dumping and Countervailing Measures

Tariffs on modular units aren’t limited to MFN schedules. Canada’s Customs Tariff Chart from the CBSA website allows the federal government to impose anti-dumping and countervailing duties when foreign exporters are found to be selling goods in Canada at unfairly low prices or receiving subsidies from their governments.

Under Canada’s Special Import Measures Act (SIMA), certain fabricated industrial steel components, many of which share similar materials, fabrication methods, and supply chains with modular building systems, have been subject to significant anti-dumping and countervailing duties. In some cases, duties as high as 45.8% have been applied to Chinese exporters that did not cooperate with the review process.

While these measures do not directly target volumetric modular units typically classified under HS 9406, there have been documented instances where fabricated structural steel components and certain unitized wall panel systems were captured under SIMA findings, resulting in substantially higher import duties. This underscores the broader trade risk faced by prefabricated building components that fall outside the prefabricated-building classification, even when they are integral to modular or off-site construction systems.

Tariff-Rate Quotas and Steel Supply Policy

Tariff policy is not static. In 2025, the Government of Canada introduced tariff-rate quotas (TRQs) on imported steel mill products from non-FTA partners, allowing limited quantities to enter at reduced duty before higher surtaxes apply. This effort aims to stabilize domestic markets and prevent overreliance on imports; however, it also underscores that steel supply and pricing are now inseparable from construction trade policy.

Given that modular units are essentially fabricated structures heavily reliant on steel framing, TRQs and surtaxes on non-FTA steel complicate the cost calculus for Canadian modular manufacturers and developers alike.

What Industry Voices Are Sharing

Industry organizations such as the Modular Building Institute (MBI) have repeatedly warned that tariffs on prefabricated buildings and components undermine the very efficiencies modular construction promises. In policy statements and interviews, MBI has emphasized that tariffs increase costs, disrupt supply chains, and discourage innovation—particularly in housing and healthcare delivery.

Canadian modular manufacturers echo a more nuanced concern. While there is broad support for protecting domestic manufacturing capacity, many builders acknowledge that industrialized construction relies on global material flows, especially during periods of rapid scaling.

The challenge, as articulated in Canadian housing and construction policy discussions, is not whether to allow imports, but how to align trade policy with long-term manufacturing growth, rather than forcing the industry into short-term, project-by-project decisions.

Why Tariff Policy Matters for Canada’s Modular Agenda

Tariffs are more than a line item in a customs schedule. They shape where factories are built, how projects are financed, and whether modular housing can scale sustainably. If modular construction is to be part of Canada’s response to its housing shortage, then trade policy must be considered alongside housing policy.

A forward-looking modular strategy might include:

Clear tariff guidance for modular imports and components

Incentives or exemptions tied to housing delivery outcomes

Strategic partnerships with FTA countries to leverage global capacity

Support mechanisms for domestic modular manufacturers to scale

Absent a coherent trade and industrial strategy, modular construction risks operating in a policy grey zone: championed for housing goals, but constrained by tariffs, quotas, and international trade friction.

Conclusion

As Canada looks to modular construction to accelerate housing delivery, tariffs and trade policy deserve far more attention than they currently receive. For an industry grounded in manufacturing logic, understanding how goods cross borders, and at what cost, is essential to unlocking modular’s full potential.

Whether domestic factories are producing the units or they are sourced from abroad, Canada’s trade regime will continue to influence modular construction outcomes. A clear policy that aligns housing goals with industrial and trade objectives could unlock not just more modular housing, but a more resilient manufacturing sector at the heart of Canada’s built-environment future.

•••

XLBench is your go-to platform for modular construction insights, setting industry benchmarks, fostering expert discussions, and sharing the latest trends. Through Benchboard, we provide data-driven research, thought leadership, and in-depth analysis to advance modular innovation.

Stay informed and be part of the conversation—follow XLBench for the latest updates, expert insights, and industry trends.

•••

xL Architecture & Modular Design (XLA) is an innovative architecture firm redefining the future of building through off-site construction technologies. With expertise in volumetric modular designs, and panelized building systems, we create cutting-edge solutions that seamlessly integrate form, function, and sustainability.